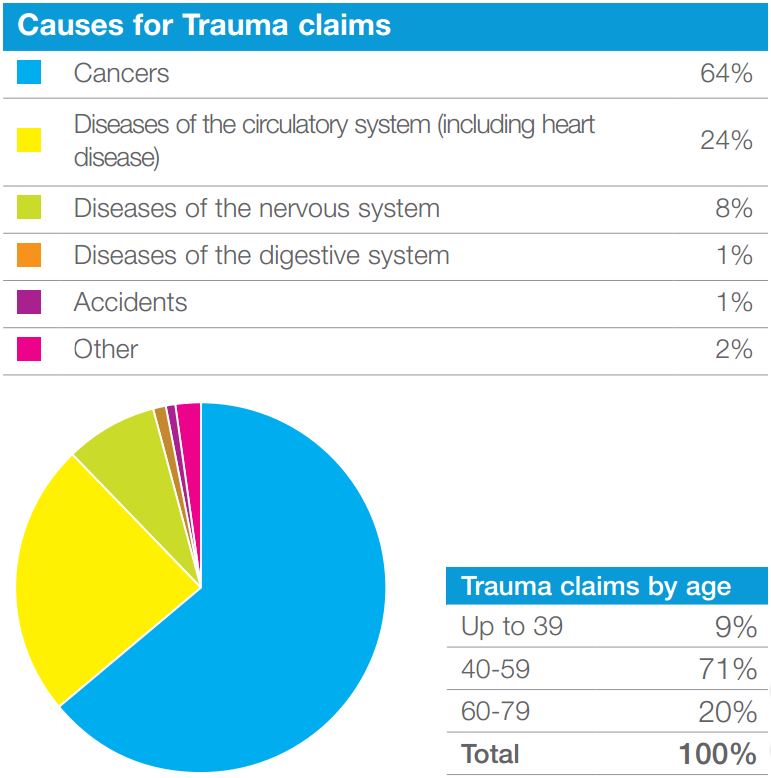

Trauma insurance, also known as Critical Illness Insurance, provides a lump sum payment if you have a heart attack or stroke or are found to have a serious cancer or the like. It is designed to fill the gap which neither income/disability insurance nor private health cover would extend to cover.

Recovering from a serious illness may introduce the financial stress of medical costs, loss of income and rehabilitation expenses. Other capital expenses such as;

- the need to make modifications to the home,

- buying a purpose built motor vehicle,

- employing a home nurse or seeking offshore medical treatment

These expenses can all adversely impact on your financial situation.

Trauma insurance benefits can also assist with the cost of living away from home and travelling to receive medical treatment.

Contact us today to review your insurance requirements for peace of mind that you and your family will be looked after in the unfortunate event of a claim.

Life Insurance

We can assist you to apply and review Life, TPD and Trauma Insurance to protect your most important asset – You!

Learn MoreTPD Insurance

Total and Permanent Disablement (TPD) occurs when, through illness or accident, you are unable to return to any, or your own usual, occupation.

Learn MoreTrauma Insurance

Trauma Insurance (otherwise known as Critical Illness Insurance) provides a lump sum payment if you have experience Critical Illness or Trauma .

Learn MoreIncome Protection

Income Protection insurance helps take the financial pressure off you if you cannot work due to sickness or injury.

Learn MoreBusiness Expense Insurance

Like Income Protection, Business Expenses Insurance ensures that in the unfortunate event where you are unable to work, your expenses can continue to be covered.

Learn More